How Institutional Investors May Be Driving Up Rents and Contributing to the Home Affordability Crisis.

- 2008 marked the beginning of a new era in which large-scale investors began acquiring significant portions of U.S. residential housing stock.

- Institutional investors and private equity firms have exerted their influence on the housing market through the purchase of single-family homes for rental purposes.

- This has led to higher rents, especially in markets where there is limited competition from traditional landlords and can place a significant burden on renters.

The American dream of owning a home has long been a cornerstone of society, embodying stability, security, and prosperity. However, in recent years, a significant shift has occurred in the housing market, with institutional investors and private equity firms increasingly playing a prominent role. This trend has sparked debates about its impact on rental and home pricing, as well as its implications for the broader economy and society as a whole.

Historically, individual homeowners and small-scale investors dominated the residential real estate market in the United States. However, the landscape began to change dramatically following the 2008 financial crisis. In the aftermath of the housing market collapse, institutional investors and private equity firms saw an opportunity to capitalize on distressed properties and capitalize they did. This marked the beginning of a new era in which large-scale investors began acquiring significant portions of U.S. residential housing stock. Unlike traditional, smaller-scale "mom and pop" landlords, these investors often can outbid prospective individual homeowners with all-cash offers and fast-track their purchases by waiving common steps in the buying process that would be too risky for individual buyers to skip.

One of the primary ways in which institutional investors and private equity firms have exerted their influence on the housing market is through the purchase of single-family homes for rental purposes. This phenomenon, often referred to as the “institutionalization of the rental market”, has had far-reaching consequences. One of the most crucial is that it has raised concerns about the concentration of ownership in the hands of a few powerful entities and its impact on rental affordability and housing availability. MetLife Investment Management predicts institutional investors may control 40% of the U.S. single-family rental homes by 2030.

US Rent Affordability Drops to Lowest Level in Decades

One of the most immediate effects of institutional investment in the rental market has been the increase in rental prices. As large investors acquire vast portfolios of single-family homes, they gain significant market power, allowing them to set rental rates in many areas. This has led to higher rents, especially in markets where there is limited competition from traditional landlords and can place a significant burden on renters, particularly low-and moderate-income households who may already be struggling to make ends meet.

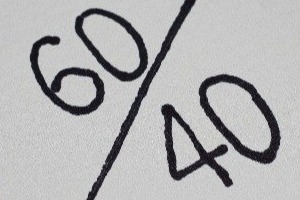

"For the first time in decades, the rent-to-income ratio has reached 40% at the height of U.S. inflation, marking one of the least-affordable rental markets ever." - Yanling Mayer, Principal Economist, CoreLogic

Moreover, the influx of institutional capital into the rental market has also contributed to a reduction in the supply of homes available for purchase. As investors snap up properties to add to their rental portfolios, they effectively reduce the number of homes available for sale to owner-occupants. This can create additional challenges for prospective homebuyers, particularly first-time buyers who may find themselves competing with deep-pocketed investors for limited inventory. As a result, home prices can be driven up, making homeownership increasingly unattainable for many Americans.

In addition to purchasing single-family homes for rental purposes, institutional investors and private equity firms have also been active in the market for multifamily properties. By acquiring apartment buildings and other rental complexes, these entities can further consolidate their control over the rental market and exert influence over pricing and other market dynamics. This raises concerns about the displacement of existing tenants and the erosion of affordable housing options in many communities.

Moreover, the concentration of ownership in the hands of a few powerful players can distort market dynamics and reduce competition, potentially stifling innovation and limiting consumer choice.

As policymakers grapple with these challenges, it is essential to strike a balance that promotes a healthy and inclusive housing market that serves the needs of all Americans.

How can you help? The proceeds from the sale of Worthy Property Bonds are lent to both boutique developers renovating and improving individual properties as well as larger homebuilders working to put families into houses throughout the Carolinas, so investing with Worthy continues to support making homes available and/or more valuable for individuals across the U.S.

Tags:

Community investingApril 30, 2024