Chris Rock once famously said, “You don’t pay taxes. They take taxes.”

Believe it or not, “they” may be taking a lot less of your taxes this year due to historically high inflation.

To help ensure that taxpayers aren’t pushed into higher tax brackets due to inflation, Uncle Sam has adjusted some of its 2023 tax rules. Specifically, the IRS raised its tax bracket thresholds by about 7% this year.

Although 7% won’t make up for the 22+% of purchasing power erosion that Americans have experienced since 2020, it could result in larger tax refunds for more Americans.

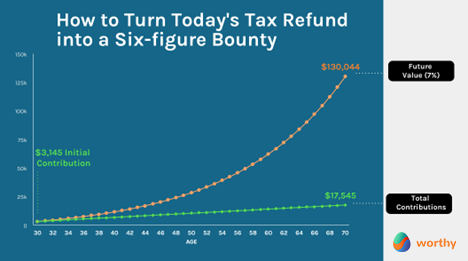

According to the IRS, thus far in 2024, the average federal income tax refund is $3,145 — an increase of just under 6% from 2023.

Fintech can help make that tax refund earn for you. In fact, it can help you turn that $3,145 into well over $100,000 by doing nothing – well, nothing, except shopping!

Here’s how:

Let’s assume you are a 30-year-old making $75,000 per year.

You can put your $3,145 tax refund into a Worthy FinTech Round-Up Account which is invested in Worthy bonds that yield 7% per annum.

According to Worthy, the average user saves $30 to $50 in monthly round-ups. Going with the low end of the round-up range, let’s assume your shopping habits allow you to amass $360 each year in your fintech savings app.

Assuming you make no other contributions other than your round-up contributions or make any withdrawals by the time you are 70 years-old, your $3,145 tax refund would be worth $130,044. Not bad for doing nothing!

And, in case you missed it, that is just ONE tax refund!

April 09, 2024