Worthy Wealth Tips are not investment advice, they are wealth -building guidance.

Welcome to another episode of Worthy Wealth Tips where we introduce new ways to build wealth in a modern, tech-driven economy. Today we are going to discuss why tokenized collectibles are poised to play an important role in modern investment portfolios.

Let’s start with the problem.

There are not enough unique investable assets, in the existing financial system, to provide proper portfolio diversification

– especially for US retail investors who are restricted to investing in publicly-traded stocks, bonds and mutual funds and only a very small number of government-sanctioned alternative investment products.

Because those publicly-traded stocks, bonds and mutual funds are mostly all byproducts of the same 4200 US listed companies, true diversification is even further limited.

So that leaves just a small number of alternative investment products to provide the necessary diversification.

Unfortunately, we can no longer even rely on alternatives to provide the needed diversification because most of those alternative products have become more correlated with the traditional stocks, bonds and mutual funds. This is exactly what happens when institutional investors (like hedge fund traders) all add the same alternative assets to their portfolios at the same time.

Let me explain what’s going on by using stocks and bitcoin as an example. When bitcoin first emerged, it had zero correlation to stocks. None. Both traded completely independently of one another. It wasn’t until 2021when the price of bitcoin surpassed a trillion dollars in market capitalization did institutional investors start entering the crypto space in droves. And it was precisely during this time that the correlation between Bitcoin and the S&P 500 began to spike. According to a recent study from Georgetown University, the correlation between bitcoin and the S&P500 increased over 312% starting in early 2021.

Even in more recent times, as the stock market was declining on rising inflation, bitcoin was also trading down – despite bitcoin having all of the markers of being a good hedge against inflation.

So why does institutional acceptance cause an increase in asset correlation? Well, the main reason is that when stocks are going down, institutions tend to sell off other assets in their portfolio, like bitcoin, - not because of any fundamental issues – but because institutions need to cover shortfalls in their stock positions.

Now, if there were an unlimited supply of different assets to invest in, institutional selling wouldn’t really be an issue. But since there is such a limited pool of assets that all share similar DNA, it does.

Instead of a pool, we need is an ocean full of assets – and ones that are not descendants of listed companies.

Collectibles such as art, wine, coins, baseball cards, toys, antiques, stamps, and books are interesting portfolio diversifiers because they share no genetics with listed companies, because collectibles are all so different from one another and because collectibles have been known to provide solid appreciation over the years.

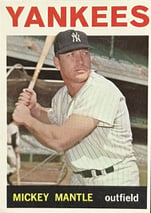

My cousin had a 1964 Tops Mickey Mantle baseball card that he bought for $5 in 1979. He sold it for a little over $1000 in 2008. But today that card would be worth $30K. That’s a nice 600,000% return. Even better than both Intel’s and Microsoft’s post IPO returns! And that Mickey Mantle card appreciated even during downturns in the stock and bond markets.

My cousin had a 1964 Tops Mickey Mantle baseball card that he bought for $5 in 1979. He sold it for a little over $1000 in 2008. But today that card would be worth $30K. That’s a nice 600,000% return. Even better than both Intel’s and Microsoft’s post IPO returns! And that Mickey Mantle card appreciated even during downturns in the stock and bond markets.

Rare wine is another collectible that has long been recognized by collectors and investors as a store of value with the potential to deliver impressive financial returns – sometimes even outperforming traditional assets like stocks or bonds over certain periods.

The problem was that until recently, collectibles such as these, were not readily tradeable.

But thanks to asset tokenization, that is all changing.

Asset tokenization is a process that creates digital tokens on a blockchain that represent digital or physical assets which can then be sold on the secondary market - just like shares of a stock.

Asset tokenization enables us to turn every product under the sun – including rare collectibles - into liquid tradeable assets just like stocks.

Video: Tokenizing Wine - The Next Big Opportunity for Collectors, Investors, and Producers.

And asset tokenization is going to create the most unprecedented portfolio diversification opportunity in the history of mankind!

Here’s how…

Collectibles fall into the category of real-world assets that exist outside of the traditional financial system.

Bain Capital estimates the value of all private assets outside the financial system to be around $540 trillion – To give you an idea of just how massive $540 trillion is… if you spent one dollar per second, it would take you over 17 million years to spend 540 trillion dollars.

Today, $540 Trillion is more than FIVE TIMES the present value of global assets under management. To put this into perspective, bitcoin, even at its 2021 peak market cap of 1.28T, was still only worth about 1% of global assets under management. So while bitcoin’s impressive appreciation was able to provide individual portfolios with greater risk adjusted returns, its relative market size was simply not big enough to prevent institutions from causing bitcoin’s correlation to stocks to increase.

But that won’t be the case for tokenized assets.

Asset tokenization will ensure that investors will have an endlessly proliferating supply of diverse investable products to choose from.

You see, unlike stocks which can take years and years and cost millions and millions of dollars to become publicly-traded, tokenized assets can be minted and tradeable within minutes for a fraction of the cost!

By adding this magnitude of unrelated investable assets into the mix on a continuous basis, asset tokenization will ensure the diversification necessary to produce much greater risk-adjusted returns for all investors!

And mark my words, asset tokenization will transform wealth creation!

If you would like to hear more about this topic, please watch this Webinar,

Tags:

Modern InvestingOctober 26, 2023